When your doctor prescribes a brand-name medication but your insurance insists you switch to a cheaper generic, it’s not just a paperwork headache-it can affect your health. Maybe the generic didn’t work before. Maybe it caused a bad reaction. Or maybe your condition is too sensitive to risk a switch. If your insurer denies coverage for the medication you need, you don’t have to accept it. You have rights. And you have a clear path to fight back.

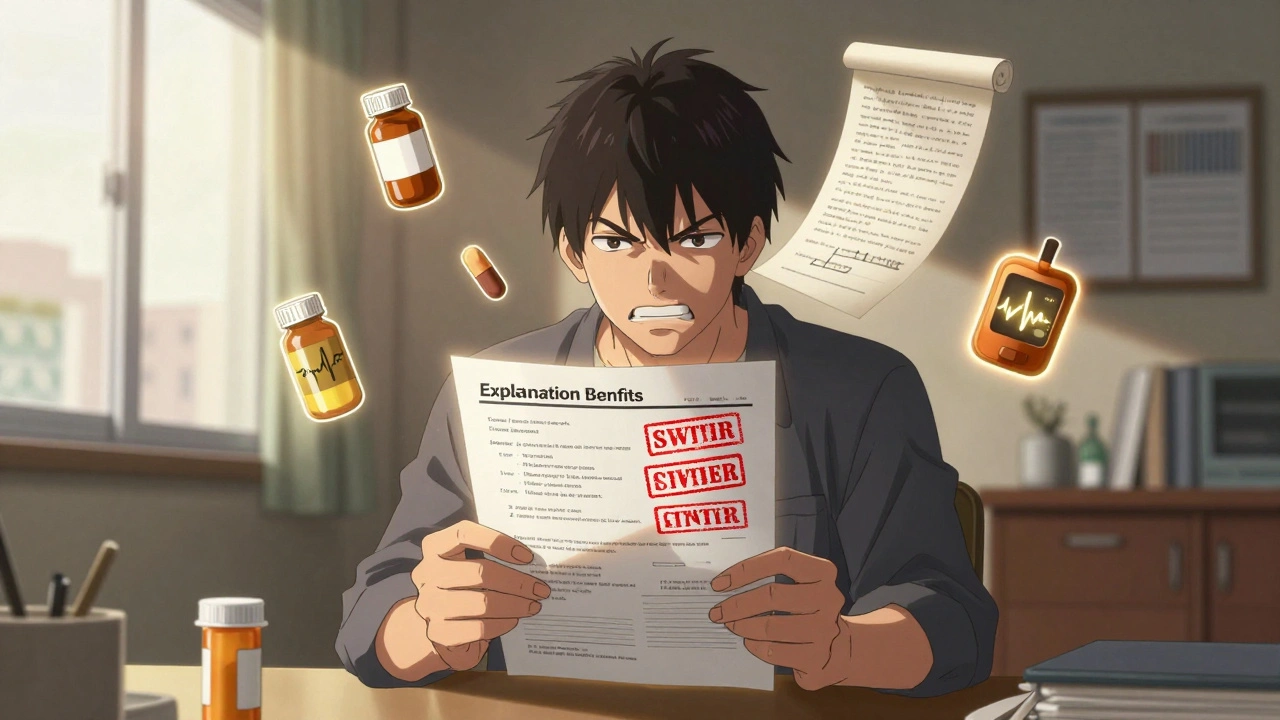

Understand Why Your Insurance Denied the Claim

Your first step is reading the Explanation of Benefits (EOB) letter from your insurer. This isn’t just a bill summary-it’s your roadmap. The denial reason will be clearly stated. Common reasons include:- Step therapy: You must try a cheaper generic or alternative drug first

- Formulary restriction: The drug isn’t on the plan’s approved list

- Prior authorization required: The insurer needs extra documentation before approving

- Quantity limit: You’re prescribed more than the plan allows

Don’t ignore this letter. It tells you how many days you have to appeal-usually 180 days for commercial plans, 120 for Medicare Part D. Miss the deadline, and your chance to appeal disappears.

Gather the Right Documentation

A successful appeal doesn’t rely on emotion-it relies on evidence. Your doctor’s letter is the most powerful tool you have. The American Medical Association says the top three things that make appeals succeed are:- Clear explanation of why the generic won’t work for you

- Proof you’ve already tried alternatives and they failed

- Citation of clinical guidelines from trusted sources like the American College of Physicians or specialty societies

For example, if you’re on a brand-name medication for epilepsy and a generic caused seizures, your doctor should document the exact date, dosage, and reaction. If you have Type 1 diabetes and a generic insulin caused severe low blood sugar, include your glucose logs. Insurance reviewers are trained to look for this data. Without it, your appeal is likely to fail.

Also collect:

- Your insurance policy number

- The exact name and dosage of the medication denied

- Any previous EOBs showing prior denials or failed attempts with alternatives

- Letters from specialists if you’re seeing one (like an endocrinologist or neurologist)

Studies show that appeals with this level of detail have a 78% success rate. Those without? Only 29%.

Submit the Formal Appeal

Most insurers have a specific form for drug appeals. You can usually find it on their website under “Member Services” or “Prior Authorization.” If you can’t find it, call customer service and ask for the “Prescription Drug Exception Request Form.”Fill it out completely. Don’t leave anything blank. Include:

- Your full name and member ID

- Prescribing doctor’s name and contact info

- Exact drug name, strength, and quantity

- Reason for the exception (use your doctor’s letter as the attachment)

Attach your doctor’s letter and all supporting documents. Send it by certified mail or upload it through the insurer’s secure portal. Keep a copy of everything. Some insurers require you to submit appeals online, others accept fax or mail. Check their rules.

Timeline matters. For medications you haven’t started yet, insurers have 30 days to respond. If you’re already taking the drug, they have 60 days. If your condition is urgent-like if stopping the medication could cause hospitalization-you can request an expedited appeal. They must respond within 4 business days.

Request a Peer-to-Peer Review

This is where most appeals succeed. If your initial request is denied, ask for a peer-to-peer review. That means your doctor talks directly to the insurer’s medical director.It’s not automatic. You have to ask for it in writing. Say: “I request a peer-to-peer clinical review between my physician and your medical director to discuss the medical necessity of [medication name].”

Research shows this step alone increases approval rates to over 75%. Why? Because insurers’ reviewers are often nurses or pharmacists who don’t fully understand complex conditions. When your doctor explains your case directly-using clinical language, referencing guidelines, and sharing real patient data-it changes the conversation.

California’s AB 347 law requires insurers to grant these reviews within 72 hours for urgent cases. Even if you’re not in California, most major insurers follow similar practices.

Know Your Next Steps if the Appeal Is Denied

If your internal appeal is denied, you don’t give up. You move to the next level: external review.For commercial insurance, this means an independent third party reviews your case. For Medicare Part D, it’s a five-step process:

- Redetermination (your first appeal)

- Reconsideration by a QIO (Qualified Independent Contractor)

- Hearing by an administrative law judge

- Review by the Medicare Appeals Council

- Federal court review

At the second level (QIO review), 63% of Medicare appeals are overturned. That’s your best shot.

For commercial plans, the external review is handled by your state’s insurance department. In 2022, California’s Department of Insurance resolved 92% of formal complaints in favor of patients. Every state has one. Find yours through the National Association of Insurance Commissioners (NAIC) website.

Track Your Appeal and Stay Persistent

Keep a log. Write down:- Date you submitted the appeal

- Who you spoke to at the insurer

- Reference numbers

- Any promises made (“We’ll call you back in 3 days”)

If you haven’t heard back after the deadline, call again. Don’t take “I don’t know” for an answer. Ask for a supervisor. If you’re on Medicare, call the Medicare Rights Center helpline at 1-800-MEDICARE.

Patients who track their appeals and follow up consistently are twice as likely to win. One Reddit user shared how they won after three months of calling every week. Their key? “I never missed a deadline. I never stopped asking.”

When to Get Help

You don’t have to do this alone. If your condition is complex or your appeal is denied multiple times, reach out to:- Patient Advocate Foundation - Free help with appeals and paperwork

- Crohn’s & Colitis Foundation - Specializes in GI medication appeals

- T1D Exchange - For diabetes-related coverage issues

- Your state’s insurance commissioner - They can intervene if the insurer is stalling

These organizations have templates, sample letters, and even direct advocacy teams. They’ve seen thousands of cases. Use their experience.

Why This Matters

In 2023, 78% of commercial health plans required step therapy for specialty drugs. That means if you have MS, rheumatoid arthritis, or cancer, you’re likely being pushed toward cheaper options-even when they’re not safe for you.But here’s the truth: 56% to 78% of properly documented appeals succeed. That’s not luck. That’s strategy. The system is designed to make you give up. But when you push back with facts, evidence, and persistence, you win.

One patient in Ohio successfully appealed denial of a brand-name biologic for lupus after her generic caused kidney damage. She provided lab results, her doctor’s letter citing ACR guidelines, and a history of three failed alternatives. Her appeal was approved in 14 days.

You can do the same.

How long do I have to appeal a generic medication denial?

For commercial insurance plans, you have 180 calendar days from the date of denial to file an internal appeal. For Medicare Part D, you have 120 days. Medicaid timelines vary by state, but most allow at least 60 days. Always check your Explanation of Benefits letter for the exact deadline-it’s legally required to include it.

Can I appeal if I’ve never tried the generic before?

Yes. You don’t have to try the generic first to appeal. If your doctor has a clinical reason to believe the generic won’t work for you-like a prior adverse reaction, a known sensitivity, or a condition where generics have proven less effective-you can appeal based on medical necessity. The key is documentation. Your doctor must explain why the brand-name drug is medically necessary, even without prior trial of the alternative.

What if my doctor won’t help me with the appeal?

Many doctors are overwhelmed with paperwork, but most will help if you ask. Bring them the insurer’s appeal form and say, “I need your help to explain why this medication is necessary for me.” If your doctor refuses, ask for a referral to a specialist who can write the letter. You can also contact patient advocacy groups-they often have templates your doctor can sign off on quickly. In some cases, a nurse practitioner or pharmacist can also write a supporting letter.

Are there medications that are harder to appeal for?

Yes. Psychiatric medications have lower appeal success rates-around 47%-because insurers often consider generics “equivalent.” But if you’ve had side effects like weight gain, sedation, or worsening symptoms, document them. Oncology drugs have the highest success rates (82%) because the clinical need is more obvious. GLP-1 agonists like semaglutide are seeing a surge in appeals due to high costs and rising demand. The more specific your clinical evidence, the better your chance.

Can I get my medication while my appeal is pending?

Sometimes. If your case qualifies as urgent-for example, if stopping your current medication could lead to hospitalization-you can request an expedited review. Some insurers offer temporary access to the drug during the appeal. Ask your doctor to write a letter stating that a delay would cause serious harm. You can also ask your pharmacy if they offer a short-term sample or discount program while you wait.

Does the appeals process cost money?

No. Filing an internal or external appeal is free. You should never pay a fee to appeal a drug denial. If someone asks for money to help you file, it’s a scam. Patient advocacy organizations and state insurance departments offer free help. Beware of companies offering to “guarantee approval” for a fee-they’re not legitimate.

What if I’m on Medicare Part D?

Medicare Part D has a five-step appeal process. Start with a Coverage Determination Request form from your plan. If denied, move to the second level: a review by an Independent Review Entity (QIO). This is where most approvals happen-63% of appeals are overturned here. You can request a face-to-face hearing if needed. Keep copies of every form and call the Medicare Rights Center at 1-800-MEDICARE for free guidance. They’ve helped over 100,000 people appeal drug denials.

Can I appeal if I’m on Medicaid?

Yes. All 50 states have Medicaid appeal processes, though timelines vary. Most states require you to request a hearing within 60 to 90 days of denial. Your state’s Medicaid office must provide you with appeal instructions. If you’re denied, you can request a fair hearing. Many states also have legal aid organizations that help Medicaid patients with drug appeals-search for “Medicaid legal aid [your state].”

If you’re fighting an insurance denial for a medication you need, remember: you’re not alone. Thousands of people go through this every year. The system is stacked against you-but it’s not unbeatable. With the right documents, the right timing, and the right persistence, you can get the treatment you were prescribed. Don’t let a formulary decision override your doctor’s judgment. Fight back.

Posts Comments

john damon December 12, 2025 AT 08:49

Bro this saved my life 😭 I got denied for my lupus med last year and thought I was done for... then I found this guide and fought back. Got approved in 14 days with my doctor’s letter + lab results. Insurers think we’re dumb but we’re not. 🙌

matthew dendle December 13, 2025 AT 23:03

so u just like... ask nicely and they give u the expensive stuff?? wow who knew insurance companies were just big softies 😂

Aman deep December 14, 2025 AT 04:48

This is gold. I’ve seen too many people give up because the system feels rigged. But you’re right-it’s not about yelling, it’s about showing up with proof. I helped my cousin file an appeal last month for her insulin. She had glucose logs, specialist notes, even a photo of her hypoglycemic episode. They approved it in 11 days. Don’t underestimate the power of paperwork. 🙏

Sylvia Frenzel December 15, 2025 AT 04:07

Another reason why American healthcare is broken. You should never have to fight for the meds your doctor prescribes. This shouldn’t be a skill. It should be a right.

Raj Rsvpraj December 16, 2025 AT 03:28

Of course, the only people who succeed are those who have access to specialists, time off work, and the cognitive bandwidth to navigate Byzantine bureaucratic labyrinths-while simultaneously managing chronic illness. What a brilliant system we’ve built. Truly, the pinnacle of human ingenuity.

Jack Appleby December 17, 2025 AT 06:00

Actually, the 78% success rate cited here is misleading-it conflates internal appeals with external reviews. The real success rate for initial denials without peer-to-peer review is closer to 31%. And the AMA doesn’t ‘say’ these things-they publish guidelines that insurers often ignore. Also, ‘clinical guidelines’ are not universally accepted; many are industry-influenced. But yes, documentation matters. Just don’t assume this is a fair system.

Sarah Clifford December 18, 2025 AT 12:54

my doctor literally cried when i told him my insurance denied my med. i had to beg him to write the letter. he said he’s done 20 of these this month alone. we’re all just screaming into the void.

Stephanie Maillet December 18, 2025 AT 14:09

It’s interesting how we’ve turned healthcare into a legal battleground. The original intent of insurance was to share risk-not to gatekeep care through paperwork. There’s a deeper philosophical question here: When does cost-benefit analysis become dehumanization? Maybe the real issue isn’t the appeal process-it’s that we’ve allowed profit to dictate healing.

David Palmer December 19, 2025 AT 08:47

why are we even talking about this? just go to canada. they give you the meds. no forms. no drama. just pills. why are we still here fighting insurance bots?

Paul Dixon December 20, 2025 AT 01:45

Just wanted to say thank you for writing this. I’ve been through this twice now with my MS med. It’s exhausting, but you’re right-persistence pays off. I kept a spreadsheet of every call, date, and rep I talked to. When I finally got approved, I cried in the pharmacy. You’re not alone. Keep going.

Vivian Amadi December 21, 2025 AT 10:27

Stop lying. 78% success? No. That’s the success rate when you have a neurologist at Mayo Clinic writing your letter. Most people can’t even get a 10-minute appointment. This guide is for the privileged. The rest of us just suffer in silence.

Jimmy Kärnfeldt December 22, 2025 AT 06:58

There’s hope in this. I know it feels like the system is rigged-but every time someone fights back and wins, it makes it a little easier for the next person. I’ve been on this journey for three years. I’ve lost sleep, cried in parking lots, and called my doctor at midnight. But I got my med. And now I help others do the same. You’ve got this.

Ariel Nichole December 23, 2025 AT 01:53

Love this. I used this exact process for my dad’s Parkinson’s med. Took 4 weeks, but we got it. I printed out the whole guide and gave it to his nurse. She said it was the clearest thing she’d seen all year. Thank you for making this so accessible.

Taylor Dressler December 23, 2025 AT 02:26

Minor correction: The 180-day window applies to commercial plans under the Affordable Care Act, but Medicaid timelines vary by state-some allow only 60 days. Also, peer-to-peer reviews are not guaranteed by federal law; they’re a voluntary practice adopted by most insurers, not a right. Always confirm your plan’s specific appeal procedures via your Summary of Benefits and Coverage document. Still, this guide is 95% accurate and extremely useful.

Aidan Stacey December 24, 2025 AT 20:08

My niece had a seizure after switching to a generic epilepsy med. Her neurologist wrote a 5-page letter citing FDA warnings, EEG results, and three prior failures. The insurer denied it. We asked for peer review. They approved it the next day. This isn’t luck. It’s strategy. And if you’re reading this-you already have the courage. Now go get your meds.

Write a comment