It’s 2025, and hospitals are rationing antibiotics. Cancer centers are delaying treatments. Parents can’t find pediatric insulin. These aren’t emergencies from a pandemic-they’re the new normal. Behind every drug shortage is a manufacturer caught between rising costs and frozen prices, squeezed so hard they’re shutting down production lines. This isn’t about bad luck. It’s about financial strain so severe that making life-saving drugs no longer makes economic sense.

Why Cheap Drugs Are Now Unprofitable

Generic drugs were supposed to be the solution: affordable, reliable, mass-produced. But in 2025, the math has broken. The average price of a generic injectable antibiotic hasn’t changed since 2018-even as the cost of its active pharmaceutical ingredient (API) jumped 37% over the same period. That’s not inflation. That’s a system designed to fail. Raw materials like benzene, chloroform, and rare metal catalysts used in synthesis are now subject to new U.S. and EU tariffs. A single batch of metronidazole, once made for $12 per kilogram, now costs $18.50 to produce. But hospitals and pharmacies still pay $14. There’s no room to absorb the difference. Manufacturers can’t raise prices without losing contracts. They can’t cut corners without risking FDA violations. So they do the only thing left: stop making it. According to the Manufacturers Alliance’s 2025 survey, 72% of generic drug producers have reduced output on at least one product because input costs outpaced revenue. The most affected? Injectable antibiotics, steroids, and cardiovascular drugs-products with thin margins and high volume. These aren’t luxury items. They’re essentials.The Supply Chain Is Fractured

It’s not just about cost. It’s about control. Over 80% of the world’s API production is concentrated in just two countries: India and China. Both face their own pressures. China’s environmental crackdowns have shut down dozens of small API plants since 2023. India’s drug regulators now require real-time quality monitoring for every batch, adding $200,000+ in compliance costs per facility. Add to that: semiconductor shortages. Modern drug manufacturing relies on automated reactors, sterile filling lines, and real-time monitoring systems-all dependent on chips. When those chips are delayed, production halts. A single 30-day delay in a filling machine’s control board can mean a 12-week backlog for a life-saving chemotherapy drug. And when one plant goes offline, there’s no backup. The FDA approved only 12 new generic drug facilities in the U.S. in 2024. Ten years ago, it was 47. The infrastructure to replace lost capacity simply doesn’t exist. Manufacturers aren’t lazy. They’re trapped.Who Pays the Price?

Hospitals don’t want to ration. Pharmacists don’t want to call patients and say, “We’re out.” But when a vial of epinephrine costs $180 instead of $45, and insurance won’t cover the difference, someone has to make a choice. In 2025, the average hospital spends 19% more on drug procurement than it did in 2022. That’s $1.2 billion extra across the U.S. healthcare system just for the same volume of generic drugs. Some institutions are turning to black-market suppliers. Others are stockpiling-but that’s risky. Many drugs expire in 12 to 24 months. One hospital in Ohio bought 6 months’ supply of doxycycline in 2024. Half of it expired unused by June 2025. Patients are paying too. Those without insurance are skipping doses. Diabetics are using expired insulin. Asthma patients are reusing inhalers past their expiration date. The CDC recorded a 14% spike in preventable ER visits for uncontrolled chronic conditions in Q1 2025-directly tied to drug unavailability.

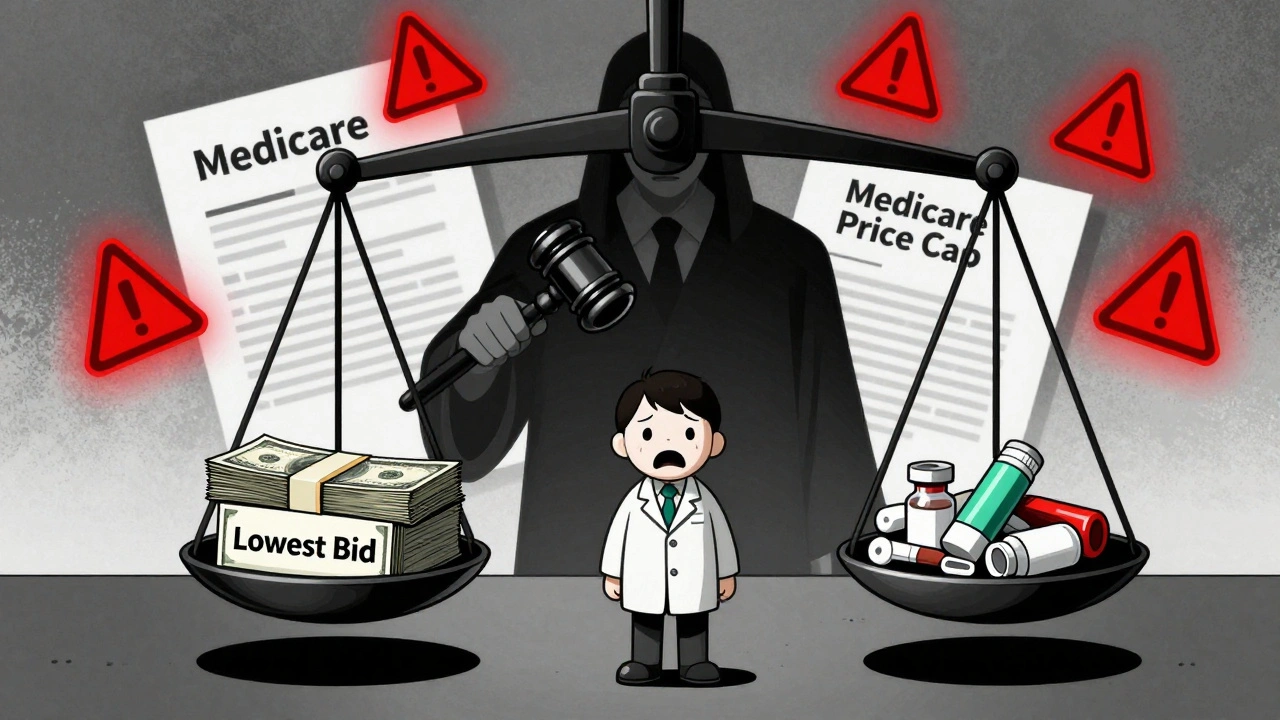

Why Price Controls Backfire

The government keeps saying, “We need lower drug prices.” But when you force manufacturers to sell a product below cost, they stop making it. That’s not theory. It’s data. The Medicare Drug Price Negotiation Program, launched in 2023, targeted 10 high-cost drugs. It worked-prices dropped 30-50%. But in 2025, three of those drugs had partial or full shortages because the manufacturers couldn’t cover production costs at the new price. One company, a small U.S.-based generic maker, shut down its entire sterile injectables division after losing $4.2 million on a single negotiated drug. The same thing happened with Medicaid’s 2024 rebate rules. Manufacturers had to pay back 100% of the difference if a drug’s average sales price fell below the negotiated rate. Many responded by withdrawing from the program entirely. Now, 117 drugs are unavailable to Medicaid patients-up from 42 in 2022. Price controls don’t fix the system. They expose its fragility.What’s Working: The Few Who Survived

Not all manufacturers are failing. A handful have adapted. They didn’t wait for policy changes. They changed their own business models. One company in North Carolina, MediCore Labs is a U.S.-based generic drug manufacturer that produces injectable antibiotics and antivirals, doubled its output in 2024-not by cutting costs, but by investing in vertical integration. They bought a chemical plant in Tennessee that makes their own API. Now they control 90% of their raw material supply. Their margins are down 4% from 2023, but they’re still profitable. And they’ve never had a shortage. Another, PharmaSynth Solutions is a mid-sized manufacturer specializing in oncology generics, switched from bulk production to just-in-time manufacturing using AI-driven demand forecasting. They reduced inventory costs by 31% and cut waste by 47%. Their production lines run 98% of the time-because they only make what’s needed, when it’s needed. These companies didn’t rely on government bailouts. They didn’t lobby for price hikes. They rebuilt their supply chains from the ground up. They’re not outliers. They’re proof that change is possible.

The Road Ahead: No Easy Fixes

There’s no quick fix. No policy tweak will solve this overnight. But there are steps that could help:- Strategic stockpiling for critical drugs, funded by public-private partnerships-not just emergency reserves, but ongoing buffers.

- Tariff exemptions for API imports used in life-saving generics, not just luxury pharmaceuticals.

- Incentives for domestic API production-tax credits, low-interest loans, and fast-tracked FDA approvals for U.S.-based manufacturers who commit to long-term production.

- Reforming procurement so hospitals can pay slightly more for reliable suppliers, rather than always choosing the cheapest bid.

What You Can Do

If you’re a patient, know your options. Ask your pharmacist: “Is there an alternative?” or “When will this be back?” Report shortages to the FDA’s MedWatch system. Your voice matters. If you’re a policymaker, stop blaming manufacturers. Start investing in resilience. The cost of a single missed chemotherapy dose can run $50,000 in emergency care. The cost of keeping a drug in production? $5,000. The system isn’t broken because of greed. It’s broken because we stopped valuing reliability over price. And now, people are paying the price.Why are generic drug prices staying the same while costs rise?

Generic drug prices are locked in by long-term contracts between manufacturers, insurers, and government programs like Medicaid and Medicare. These contracts often cap prices for years, even as raw material, labor, and compliance costs climb. Manufacturers can’t raise prices without losing contracts, so they cut production instead-leading to shortages.

Are drug shortages only happening in the U.S.?

No. Drug shortages are a global issue, but the U.S. is hit hardest because it relies on just two countries-India and China-for over 80% of its active pharmaceutical ingredients. Other countries have more domestic production or national stockpiles. The U.S. has prioritized low prices over supply resilience, making it more vulnerable to disruptions.

Can the FDA fix drug shortages by approving more manufacturers?

The FDA has approved more facilities in recent years, but the process still takes 18-36 months. Even then, new manufacturers need access to raw materials, skilled labor, and reliable supply chains-which are just as scarce. Approving more plants doesn’t solve the root problem: no one can profitably make these drugs under current pricing.

Why don’t manufacturers just raise prices?

Many can’t. Generic drugs are sold through bulk contracts with hospitals, pharmacies, and government programs. If a manufacturer raises prices, they lose those contracts. Competitors who still sell at the old price win the business-even if they’re losing money. This creates a race to the bottom where the only winner is the buyer, and the loser is the patient.

Is there a long-term solution to prevent future shortages?

Yes-but it requires investment, not just regulation. Building domestic API production, offering tax credits for reliable manufacturers, creating strategic stockpiles for critical drugs, and allowing flexible pricing for essential generics are proven strategies. Countries like Germany and Canada have fewer shortages because they pay slightly more to ensure continuity. The U.S. can too-it just needs to value health over price tags.

If you’re a healthcare provider, advocate for procurement policies that reward reliability over lowest cost. If you’re a taxpayer, understand that saving $0.50 on a pill today could cost $500 in an ER visit tomorrow. The choice isn’t between expensive drugs and cheap ones. It’s between sustainable access and unpredictable shortages.

Posts Comments

Alicia Marks December 3, 2025 AT 03:04

This is heartbreaking, but not surprising. I work in a pediatric clinic-we’ve had to switch kids to oral insulin because the injectable is gone. Parents are terrified. We need action, not just posts.

But hey, at least we’re talking about it now. That’s a start.

Paul Keller December 3, 2025 AT 19:31

It is an incontrovertible fact that the commodification of pharmaceuticals-once regarded as a public good-has devolved into a predatory market structure wherein profit maximization supersedes human survival. The systemic collapse of generic drug production is not an accident; it is the logical endpoint of neoliberal economic policy that treats life-saving molecules as interchangeable widgets. The FDA’s approval backlog, the tariff-induced supply chain fragility, and the Medicaid rebate trap are not isolated failures-they are symptoms of a deeper pathology: the refusal to recognize healthcare as a right, not a commodity. Until we reframe the entire paradigm, we will continue to witness preventable suffering masked as ‘market efficiency.’

Shannara Jenkins December 5, 2025 AT 06:57

I just talked to my pharmacist yesterday-she said they’re out of metronidazole again. No backorders, no ETA. Just ‘sorry.’

But I’m so glad someone’s finally putting this in words. My mom’s on chemo and they’re using expired drugs just to keep her alive. We need to stop pretending this is just ‘a cost issue.’ It’s a moral crisis.

Elizabeth Grace December 5, 2025 AT 07:56

Ugh. I’m so tired of this. I’ve been calling my insurance for weeks trying to get my dad’s blood pressure med. They say ‘it’s temporarily unavailable.’ Like, what does that even mean? That someone’s just… not making it?

My dad’s 72. He doesn’t have time for ‘temporary.’

Why is no one doing anything?? 😭

Steve Enck December 7, 2025 AT 00:47

Let us not conflate causation with correlation. The assertion that price controls cause shortages presupposes a static supply curve, which is economically fallacious. The real issue is the lack of vertical integration and the failure of manufacturers to internalize externalities such as regulatory compliance costs. One cannot blame policy for the strategic incompetence of firms that refuse to innovate. The market does not reward stagnation-it punishes it. The fact that MediCore Labs thrives while others collapse is not evidence of policy failure-it is evidence of managerial failure among the rest.

Jay Everett December 8, 2025 AT 21:37

Bro. I just read this whole thing and I’m literally crying. 😭

These aren’t pills. These are lifelines. And we’re treating them like discount toilet paper.

MediCore Labs? That’s the kind of company we should be cloning. AI-driven just-in-time? YES. Domestic API? YES. Stop outsourcing our health to some factory in Bangalore that gets shut down because a river got too polluted.

Let’s fund the good guys. Not the cheapest. The ones who don’t quit. 🙌

Arun kumar December 9, 2025 AT 01:21

u s always blame india and china but u forget one thing-u r the biggest buyer. u pay 10$ for drug that cost 18$ to make. how u expect factory to survive? if u pay more, they make more. simple math. but u want cheap and then cry when no medicine. its like asking chef to cook 5 star meal for 2$ and then say why food taste bad. 🤷♂️

Zed theMartian December 9, 2025 AT 03:10

Oh wow. A 2,000-word essay on how capitalism failed? Shocking. I’m sure the real issue is that people are too lazy to grow their own medicine in their backyard hydroponic labs. Maybe we should all just start brewing penicillin from moldy bread? At least then we wouldn’t be dependent on those evil corporations… or India. Or China. Or… anyone. 🌍🪄

Ella van Rij December 10, 2025 AT 17:47

Wow. So the solution is… to pay more? How original. I’m sure the 87% of Americans who can’t afford a $400 insulin prescription would just love to pay $100 for a drug that’s ‘reliable.’

Also, ‘strategic stockpiling’? That’s just a fancy way of saying ‘let’s hoard medicine like it’s toilet paper during a pandemic.’

Thanks for the thought-provoking… I mean, completely tone-deaf… post. 😘

Lynn Steiner December 11, 2025 AT 00:26

Let’s be real. This is all because of illegal immigrants stealing our medicine jobs. The FDA approves 12 plants? In 2024? We used to have 47. Where did they go? China. India. Everywhere but AMERICA.

Build the plants. Hire Americans. Pay them. Stop outsourcing our health to people who don’t even speak English properly.

And stop crying about ‘affordability.’ We can afford to save lives. We just don’t want to. 💪🇺🇸

मनोज कुमार December 11, 2025 AT 22:41

API cost rise 37% but price fixed since 2018 so shutdown is logical outcome. no mystery. u r not paying for drug u r paying for regulatory compliance and labor. fix the system not the price. also why u expect u s to make all api when u r biggest consumer? logic fail.

Joel Deang December 12, 2025 AT 06:00

Man I just flew back from Delhi last month and saw a tiny factory making metronidazole in a garage with a fan blowing over the vats. 😅

But you know what? They were still making it. Just… barely. Like a miracle.

Maybe we need to stop thinking of drug production like a Silicon Valley startup and more like a family bakery that just keeps showing up-even when the oven’s broken.

We gotta honor that. 🙏❤️

Roger Leiton December 12, 2025 AT 14:20

Okay but… what if we just paid a little more? Like $1 more per vial? Would that be the end of the world? Or would it mean a diabetic kid gets insulin this week instead of next month?

I feel like we’re so obsessed with saving 50 cents on a pill that we’re willing to risk someone’s life. Isn’t that… kind of insane?

Just asking. 🤔

Laura Baur December 12, 2025 AT 14:55

It is not merely a matter of economics, nor even of public policy-it is an existential indictment of the American moral framework. To treat pharmaceuticals as fungible commodities is to deny the sanctity of biological existence. The fact that a hospital must ration antibiotics while simultaneously spending millions on executive bonuses reveals a profound epistemological failure: we have conflated value with price, and human dignity with balance sheets. The solution is not regulatory tinkering or tariff exemptions-it is a radical reorientation toward a bioethical imperative wherein the preservation of life is the sole metric of economic legitimacy. Until then, we are not a society. We are a marketplace with a pulse.

Write a comment