When a brand-name drug loses its patent, a flood of cheaper generic versions hits the market. That’s not just good news for patients-it’s a financial earthquake for the entire U.S. healthcare system. The FDA generic approvals don’t just make medicines affordable; they save tens of billions of dollars every single year. But those savings don’t come in a steady stream. Some years, the numbers spike. Others, they dip. Here’s what’s really happening, year by year.

How the FDA Measures Generic Savings

The FDA doesn’t just count how many generic drugs get approved. They track what happens after approval-specifically, how much money is saved in the first 12 months. That’s the key metric. When a new generic enters the market, the brand-name version usually drops its price fast. Sometimes by 70% or more. The FDA calculates savings by comparing what patients and insurers paid before the generic arrived versus what they paid after. It’s not just about the generic’s low price-it’s also about the brand’s price drop. That’s the real savings.

For example, in 2019, a handful of big-name drugs went generic all at once. One of them was the cholesterol drug Simvastatin. Before generics, it cost over $100 a month. After? $10. That one switch saved billions in just a year. The FDA tracks these spikes because they show the immediate impact of new competition.

Year-by-Year Breakdown: First Generic Approvals

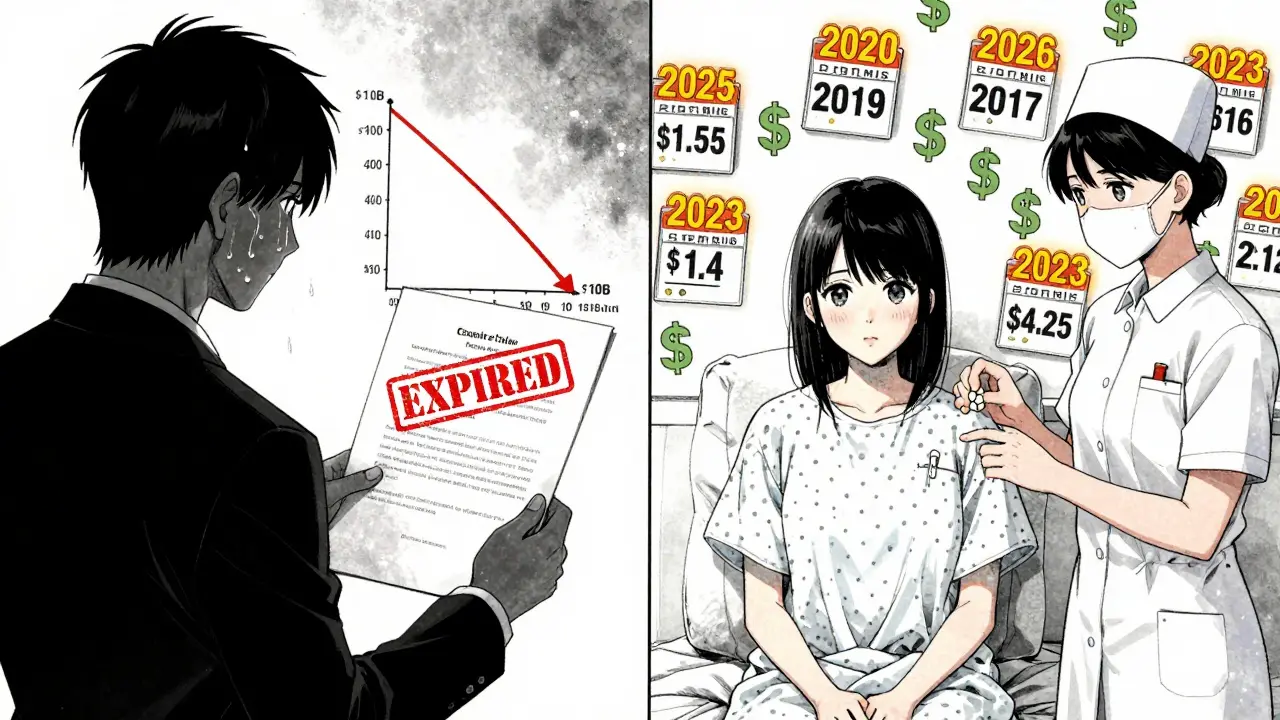

Not all generic approvals are equal. The biggest savings come from the first generic version of a drug that was previously only available as a brand. These are the game-changers. Here’s what the data shows:

- 2018: $2.7 billion saved from first-time generic approvals

- 2019: $7.1 billion saved-the highest year on record

- 2020: $1.1 billion saved

- 2021: $1.37 billion saved

- 2022: $5.2 billion saved

That 2019 peak? It wasn’t luck. Four major drugs lost patent protection that year, including two blockbuster medications used by millions. One of them, a diabetes drug, had over $10 billion in annual sales before generics. When the first generic hit, the price dropped 85% in six months. That’s the kind of shockwave the FDA tracks.

Then came 2020-and the numbers crashed. Why? Fewer big patents expired. No blockbuster drugs went generic. The savings didn’t disappear-they just didn’t come from the same scale of drugs. It’s like a lottery. Some years, you hit the jackpot. Others, you get a small win.

2022 saw a big rebound. Five major drugs, including treatments for high blood pressure and depression, went generic. The FDA noted these were "relatively large markets." One drug alone, a heart medication, saved $1.4 billion in its first year. That’s more than the entire 2020 year’s savings from every first generic approved.

Total Generic Savings: What’s Really Happening in the Market

The FDA’s numbers only show the impact of new approvals. But the real story is bigger. The Association for Accessible Medicines (AAM) tracks total savings from all generics in use each year. That includes drugs that’ve been generic for 10 years. Their numbers are staggering:

- 2020: $338 billion saved

- 2022: $408 billion saved

- 2023: $445 billion saved

That’s not a typo. In 2023, Americans saved $445 billion because they used generics instead of brand-name drugs. That’s more than the entire annual budget of the Department of Education. And it’s not just about cost-it’s about access. Over 90% of all prescriptions filled in the U.S. are generics. Yet they make up only 13% of total drug spending.

Who benefits most? Medicare saved $137 billion in 2023. That’s an average of $2,672 per beneficiary. Commercial insurers saved $206 billion. Medicaid saved the rest. In California alone, generic drugs saved the state’s Medicaid program nearly $38 billion. In Alaska? $354 million. The scale depends on population, but the impact is universal.

Who’s Really Paying Less?

Here’s the catch: savings don’t always reach the patient. Pharmacists report that 92% of generic prescriptions cost $20 or less. The average copay? Just $6.97. That’s life-changing for someone on a fixed income. But here’s the problem: pharmacy benefit managers (PBMs) often pocket most of the savings. A 2023 Senate investigation found that only 50-70% of the price drop from generics actually makes it to the patient’s pocket. The rest gets absorbed by rebates, fees, and complex pricing deals between drugmakers, PBMs, and insurers.

Take insulin. Even though generic insulin is available for under $25 a vial, many patients still pay $100 or more because their insurance plan doesn’t cover the cheaper version. The system is broken in places. But the fact that $25 insulin exists at all? That’s because of generic approvals.

Why Some Years Are Wildly Different

The swings in savings aren’t random. They’re tied to patent cliffs. When a drug’s patent expires, generic makers rush in. But not every drug has a patent that expires on schedule. Some brand companies use legal tricks-like filing endless lawsuits or pushing for new patents on minor changes-to delay generics. That’s called "evergreening." The FDA’s 2023 Drug Competition Action Plan is trying to crack down on these delays.

Also, some drugs are harder to copy. Complex biologics, like those used for cancer or rheumatoid arthritis, take years to develop as generics (called biosimilars). As of 2024, the FDA has approved only 59 biosimilars. They’re promising, but they’re not yet moving the needle like traditional small-molecule generics.

That’s why 2019 was so big-and why 2020 was so quiet. It’s not about how many generics are approved. It’s about which drugs are approved. One big drug can generate more savings than 50 small ones.

What’s Next for Generic Savings?

The pipeline is full. Dozens of major drugs are set to lose patent protection between 2025 and 2028. One of them, the asthma drug Advair, had over $8 billion in annual sales before generics. Another, the blood thinner Plavix, is next in line. If those go generic on schedule, we could see $500 billion in annual savings by 2028.

But challenges remain. The FDA is now approving more complex generics-like inhalers and injectables-that take longer to review. That’s why they’ve improved review times to 10 months for most applications. Faster approvals mean faster savings.

The real win? Patients are living longer, and they’re taking more meds. Without generics, many couldn’t afford their treatments. A diabetic patient might skip insulin if it costs $300 a month. At $25? They take it. That’s not just savings-it’s health.

Why This Matters Beyond the Numbers

These numbers aren’t just about budgets. They’re about lives. When a single pill goes from $150 to $10, it means a veteran on fixed income can afford their blood pressure meds. It means a single mom can refill her antidepressant without choosing between groceries and her prescription. It means a cancer patient can stick with their treatment instead of stopping because they can’t pay.

The FDA’s work isn’t flashy. No one celebrates a generic approval on the news. But behind every approval is a family that doesn’t have to choose. That’s the real value of these savings.

How much do generic drugs save the U.S. each year?

In 2023, generic drugs saved the U.S. healthcare system $445 billion. This includes savings from all generics in use that year, not just newly approved ones. The savings come from lower drug prices and reduced brand-name pricing after generic entry.

Why do generic savings vary so much from year to year?

Savings spike when high-revenue brand-name drugs lose patent protection. In 2019, several blockbuster drugs went generic at once, leading to $7.1 billion in savings from new approvals alone. In 2020, fewer big patents expired, so savings dropped to $1.1 billion. It’s not about quantity-it’s about which drugs go generic.

Do patients actually see lower out-of-pocket costs with generics?

Often, yes. The average generic copay is $6.97, and 92% of generic prescriptions cost $20 or less. But some patients still pay more due to pharmacy benefit manager (PBM) rebate structures. Only 50-70% of the savings from generics typically reach the patient directly.

What’s the difference between FDA and AAM savings data?

The FDA measures savings from new generic approvals in their first 12 months after approval. The AAM measures total savings from all generics used in a year, including ones approved years ago. The FDA shows immediate impact; the AAM shows total market impact.

Are biosimilars contributing to generic savings yet?

Not significantly-yet. As of 2024, the FDA has approved 59 biosimilars, which are generic versions of complex biologic drugs. But their market share is small compared to traditional generics. Savings from biosimilars are growing but still represent a fraction of the total.

What’s the biggest driver of future generic savings?

Patent expirations of major brand-name drugs. Between 2025 and 2028, dozens of high-cost drugs-including Advair, Plavix, and others-are set to go generic. If these approvals happen on schedule, annual savings could reach $500 billion by the end of the decade.